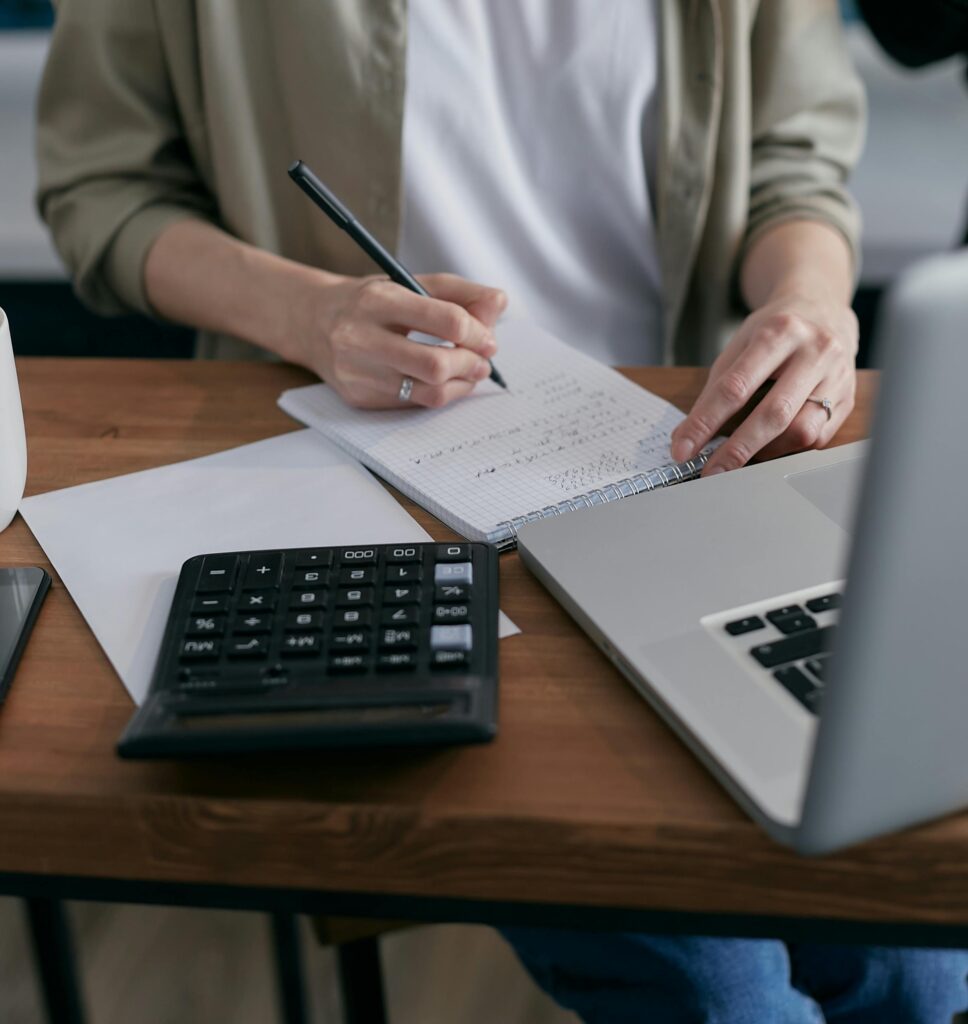

QuickBooks Bookkeeping

Streamlined, Accurate Financial Management for Your Business

Take Control of Your Financial Health with Professional Bookkeeping Support Managing accurate financial records is critical for compliance and growth. At Accounting Enterprise, our QuickBooks Bookkeeping Services are designed to ensure precision, enhance financial clarity, and reduce the burden of day-to-day accounting tasks, all while adhering to the highest industry standards.

Why Choose Our QuickBooks Bookkeeping Services?

» Expert, QuickBooks-Certified Bookkeepers

Our team includes QuickBooks-certified professionals with expertise across industries, ensuring we provide the right guidance for your specific business needs. We focus on accuracy, confidentiality, and compliance in every transaction, following best practices and regulatory requirements.

» Compliance-Focused Bookkeeping

We understand that financial compliance is paramount. Our QuickBooks Bookkeeping Services are designed to support industry-specific regulations, IRS standards, and state-specific requirements. We work diligently to ensure your records meet all necessary compliance standards, providing peace of mind for you and your business.

» why choose title 2

why choose description 2

Key Benefits of QuickBooks Bookkeeping

Precise Expense Tracking

Organised and compliant expense tracking allows for more accurate budgeting and minimises the risk of errors or oversights.

Bank Reconciliation to Prevent Discrepancies

Regular bank reconciliation ensures an accurate cash flow picture. We adhere to strict reconciliation practices to identify and resolve discrepancies swiftly, reducing compliance risks.

Detailed Financial Reports

Receive accurate, tailored reports, such as profit & loss statements and balance sheets that are useful for decision-making and fully compliant with financial reporting standards.

Accounts Receivable & Payable Management

Our bookkeeping services ensure timely tracking of accounts receivable and payable, in line with regulatory best practices.

Sales Tax Tracking & Filing

Stay compliant with state and federal tax obligations. We carefully manage sales tax tracking and filings, reducing the risk of penalties or audits.

Initial Consultation

We begin by assessing your specific requirements to ensure compliance with applicable standards and regulations. Our experts will discuss how we can tailor our services to meet your needs.

QuickBooks Integration & Setup

We assist in the setup and integration of QuickBooks, ensuring that everything is configured correctly for secure, compliant data handling.

On-going Bookkeeping & Compliance Monitoring

We provide real-time bookkeeping updates through our secure Client Dashboard, with regular audits to help you stay compliant with industry standards.

Monthly and Quarterly Reviews

Receive periodic reviews and summaries that offer insight into your financial health, complete with compliance checks to ensure you’re meeting regulatory obligations.

Why QuickBooks Bookkeeping is Essential for Your Business

Scalable Solutions with a Focus on Compliance

As your business grows, our QuickBooks Bookkeeping Services are designed to scale seamlessly, ensuring that you always have the level of support required to stay compliant and up-to-date.

Increased Financial Visibility

Transparent, organised records allow you to make better business decisions and remain fully compliant with federal, state, and industry-specific requirements.

Data Security and Confidentiality

At Accounting Enterprise, data security is paramount. We comply with data protection laws and use encryption to ensure that sensitive financial information remains

secure and confidential.

Trust Accounting Enterprise for Secure, Compliant Bookkeeping

Choose a bookkeeping partner that prioritises your business’s financial health and compliance. Let

us help you maintain accurate records, ensure tax compliance, and keep sensitive data secure.

Answers to Your Questions

What is included in the QuickBooks Bookkeeping Service?

Our services cover expense tracking, accounts receivable and payable management, bank reconciliation, financial reporting, and tax tracking, tailored to maintain regulatory compliance.

How do you ensure compliance with legal and industry standards?

We stay updated on financial regulations and industry requirements, performing regular compliance checks to meet state and federal standards.

Is my data secured with Accounting Enterprise?

Absolutely. We use secure, encrypted systems that comply with industry standards for data protection and confidentiality.

Can you help me set up QuickBooks if I’m new to it?

Yes, we provide secure QuickBooks setup and integration, ensuring data integrity and compliance from the start.